Article

By Casey Seaborn · March 11, 2025

7 Key Financial KPIs Every MSP Should Track for Sustainable Growth

Running a Managed Service Provider (MSP) business is more than just delivering great IT solutions - owners must also ensure financial stability and long-term profitability. Without a solid grasp of key financial metrics, even the most skilled MSPs can struggle with growth, cash flow, and customer retention. The best MSPs closely track their financial performance using key performance indicators (KPIs) to make informed, strategic decisions.

In this blog post, I’ll break down seven essential KPIs every MSP should monitor to drive financial success and create for themselves the ability to predict and plan for future growth.

1. Customer Lifetime Value (CLTV)

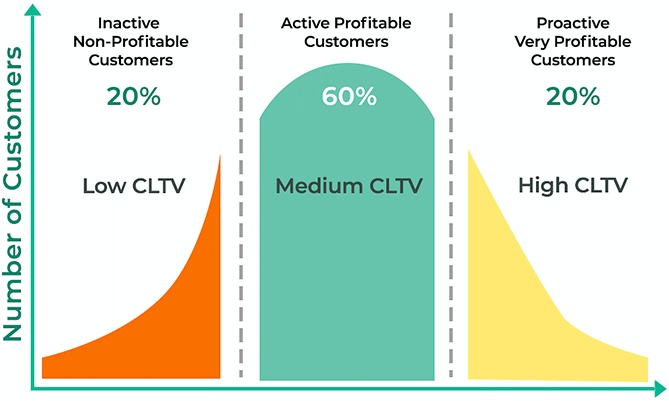

Customer Lifetime Value (CLTV) measures the total revenue generated from a single client over their entire relationship with your MSP. This metric helps you make better decisions about such things as customer retention, service upgrades, and marketing investments.

Why It Matters: A high CLTV means your clients see ongoing value in your services, helping build a stable revenue stream. If your CLTV is low, it might point to the need for stronger client engagement or reconsidering your upselling strategies.

2. Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) calculates the total expenses related to acquiring a new customer, including marketing campaigns, sales salaries, and lead generation. This KPI is important for understanding the return on investment (ROI) you are seeing from your sales and marketing efforts.

Why It Matters: If your CAC is too high compared to your CLTV, you’re spending too much to acquire customers. Tracking CAC helps ensure you’re spending efficiently and your acquisition strategy makes sense.

3. Gross Profit Margin

Gross Profit Margin shows us the percentage of revenue remaining after we subtract all the cost of goods sold (COGS). For MSPs, COGS typically includes software licensing fees, hardware expenses, and direct labor costs.

Why It Matters: A healthy MSP should aim for a gross profit margin of 50-65%. If your margins are too low, it may indicate inefficient pricing, excessive costs, or poorly-priced service offerings.

4. Recurring Revenue Growth Rate

Tracks the percentage increase in recurring revenue over a specific period, showing the stability and growth of the MSP's subscription-based income.

The Recurring Revenue Growth Rate measures how much (%) that recurring revenue is increasing over a specific period. Since MSPs rely heavily on monthly recurring revenue (MRR) and annual recurring revenue (ARR), tracking this metric is absolutely necessary.

Why It Matters: Strong growth in recurring revenue indicates financial stability and scalability. A declining or stagnant rate could signal the need for better customer retention, adjustments to your pricing, or changes to service offerings.

5. Accounts Receivable Turnover

Accounts Receivable Turnover measures how efficiently an MSP collects payments from clients. It tells us the frequency at which your outstanding invoices are converted into cash.

Why It Matters: Slow collections can create cash flow issues, making it difficult to cover expenses. If your turnover rate is low, you may consider tightening your billing policies, offering an incentive for early payments, or introducing invoicing automation.

6. Churn Rate

Churn Rate calculates the percentage of customers who discontinue services within a set time frame. High churn will severely impact your revenue and profitability.

Why It Matters: A high churn rate often signals poor service delivery, mismatched expectations, or some lack of customer engagement. Do you understand why customers leave? Knowing this helps develop your retention strategies.

7. Operating Cash Flow

Operating Cash Flow represents the cash generated from normal business operations. It indicates whether an MSP can cover its expenses without relying on external funding.

Why It Matters: Positive cash flow means that your business can handle unexpected costs, invest in growth, and remain financially secure. If your cash flow is negative, you should revisit pricing, payment terms, or look at cost management.

🛑 Important Considerations for MSPs

Set Targets Based on Industry Benchmarks

Comparing your KPIs against similar MSPs in your market helps gauge your performance. Consider joining MSP peer groups for insights and benchmarking, such as:

Monitor KPIs Regularly

Financial KPIs should be reviewed frequently to identify trends, make proactive adjustments to areas that need improvement, and anticipate future challenges.

MSP CFO is a great solution for tracking key financial metrics with precision.

Integrate Financial KPIs with Customer Metrics

Your financial health is directly tied to customer satisfaction. Tracking service-related KPIs like response time, resolution time, and client feedback can help you understand the impact of service quality on revenue.

Invest in Bookkeeping, Accounting and PSA foundation

I can’t stress enough the importance of building a solid financial foundation and accounting processes for your MSP. Your books will determine the success or failure of your business. I’ve seen countless MSPs over $1mm in annual revenue, even up to $10mm, struggle to make confident and decisive decisions due to inaccurate and/or incomplete financial data. If your books can’t produce consistent and accurate financial records, don’t worry about KPIs. Fix your accounting data, your balance sheet, P&L and revenue cycle processes first. Then worry about tracking and optimization.

Conclusion: Winning MSPs Track Their Financial Scoreboard

After surveying over 100 MSPs in 2024, we can see a clear consensus - those who consistently track financial KPIs outperform those who don’t. Having clarity into your revenue, margins, and customer behaviors gives you the confidence to make strategic decisions and grow predictably.

If you’re unsure where to start, reach out! Feel free to direct message me on LinkedIn or go to Stride Services and schedule a time to talk.

Watch Casey's guest appearance on The MSP Sales Podcast here in the Episode 9 studio recording;

Casey Seaborn

Profit Driving Accounting, Tax & Advisory for MSP & SAAS Owners

https://www.facebook.com/strideservices

http://www.linkedin.com/company/hellostride

https://www.linkedin.com/in/casey-seaborn-stride/

http://www.stride.services/

Email: casey.seaborn@stride.services

Telephone: 415-399-9844